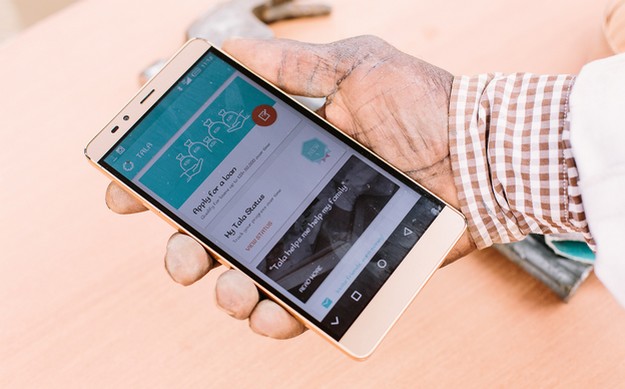

The company uses cell phones for conducting its credit business. Tala mobile is a relatively new company based in Santa Monica, America.

The four year old company was the brainchild of 33 year old Shivani Siroya. It offers loans micro loans in Tanzania, Kenya and the Philippines.

In order to assess the creditworthiness of potential borrowers, Tala mobile uses a smartphone app which is downloaded onto the cell phones of its clients. With the help of this simple smartphone app, Tala mobile gains access to a wide range of data concerning their would-be client.

Tala is able to gauge the support system and the network of the client. It also lets Tala know where the applicant is going, whom they are calling, and whether they pay all their utility bills on time.

This is very important because the personal habits of a person provide a more comprehensive insight into his / her monetary practices. When the application is approved, the borrower can have the money downloaded onto their smartphones within minutes.

The average loan is 50 dollars and carried interest rate of 11%. Tala’s repayment rate is extremely good – around 90%. The company has provided loans to around one hundred and fifty thousand people amounting to twenty million dollars. Last year, the company posted revenue of 1.5 million dollars and recorded a profit of 500 grands.

The figures are proof that Tala has, in its own way, revolutionized the micro financing spectrum with the help of a smartphone app.

One of Tala mobile’s borrowers is an old woman in Nairobi who was unable to secure a loan through traditional financing companies.

This was because she did not have a previous credit history. She came to know about Tala through her son. She downloaded the app with the intention of giving it a try.

She also replied to most questions that were asked of her over the phone. Her loan was immediately approved. She started a food stall with the initial loan.

Over the past two years, she has taken around thirty loans from Tala. Moreover, since Tala has reported her to the credit bureau, she is able to secure traditional loans as well. Right now, after having successfully run three food stalls, the borrower is ready to open a restaurant with the help of the small business loan that has been approved in her name.

Ms. Siroya started her career at an investment bank where she learned about micro-financing. She also learned about people who had genuine need for credit but were unable to secure them through regular channels.

Siroya has worked in many countries of Africa and South Asia. In these places, she came to know many people who has simple ideas that could work but they needed credit which wasn’t available to them. Once they were given the money, they were able to make wonders.

Tala mobile has a very important lesson for the traditional financial industry: try to build relationships with your clients rather than monetizing them.