Mortgage experts reveal eight key mortgage predictions for 2026, covering rates, affordability rules, and first-time buyer support.

Mortgage Market Outlook 2026: After the Rate Cuts, What’s Next?

Experts outline mortgage rate and affordability outlook for 2026

2025 marked a turning point for the UK mortgage market.

Four Bank of England rate cuts reduced the base rate from 4.75% to 3.75%, easing pressure on homeowners and encouraging lenders to lower mortgage pricing.

But 2026 looks far less predictable.

Borrowers, investors, and lenders now face critical questions:

Will rates continue falling? Will lenders loosen affordability rules further? And can first-time buyers finally catch a break?

To answer those questions, mortgage brokers, lenders, and market analysts have outlined eight key mortgage predictions for 2026 that could shape borrowing decisions across the UK.

1. One or Two Bank of England Rate Cuts — Not More

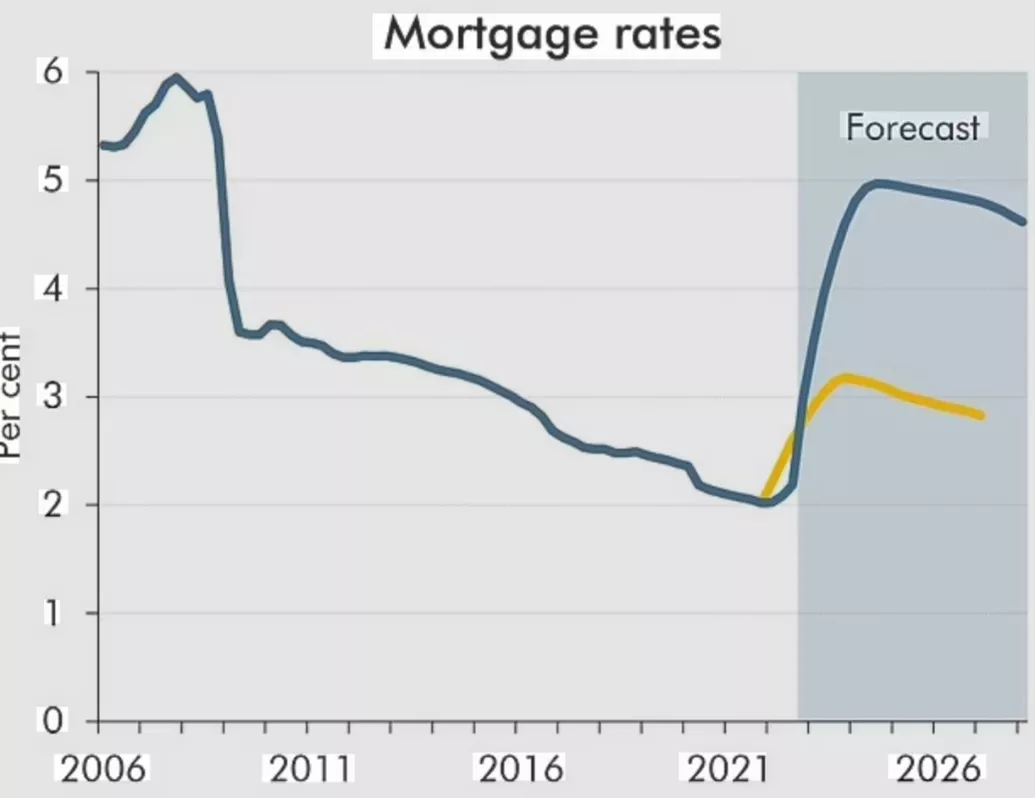

Mortgage experts broadly agree that rate cuts will slow sharply in 2026.

John Everest, director at Everest Mortgage Services, expects two cuts at most, likely in spring and late autumn, driven by easing inflation and softer economic growth.

Richard Dana, CEO of Tembo, shares that view but warns the pace will remain cautious as the economy shows signs of resilience.

Nicole Zalys, founder of Villiers & Co, is more conservative, predicting just one cut, with markets assigning only a 30% probability to a second.

What this means: Borrowers should not expect a return to ultra-cheap mortgages anytime soon.

2. Mortgage Rates Will Drift Down — Not Plunge

Even if base rates fall, lenders are unlikely to slash mortgage pricing aggressively.

Swap rates, funding costs, and risk assessments will keep average mortgage rates elevated compared to pre-2022 levels. However, small reductions across fixed and tracker products are likely throughout the year.

This creates opportunities for borrowers to secure incremental savings, rather than dramatic drops.

3. Targeted Affordability Easing, Not a Free-for-All

Lenders ended 2025 by quietly easing affordability criteria, and that trend will continue — but selectively.

According to industry experts, targeted flexibility will apply to:

- Self-employed borrowers with clean accounts

- Foreign nationals with stable UK income

- Professionals with secure salaries (NHS, teachers, civil servants)

Zalys notes that teachers, NHS staff, and civil servants could see higher income multiples. Everest confirms some lenders are already offering up to seven times income for education professionals.

4. First-Time Buyers Get More Product Innovation

Rather than broad affordability relaxation, lenders are expected to innovate around product design for first-time buyers.

Expect:

- Longer fixed terms

- Family-assisted mortgage structures

- Joint borrower sole proprietor (JBSP) options

- Higher loan-to-income flexibility for younger buyers

This trend aims to keep first-time buyers active without destabilising risk models.

5. Fixed-Rate Mortgages Regain Popularity

As volatility fades, fixed-rate mortgages will dominate again in 2026.

Many borrowers burned by recent rate shocks now prioritise certainty over chasing marginal savings. Two-, three-, and five-year fixes are expected to remain the most popular choices.

Trackers may still appeal to confident borrowers — but only those comfortable with short-term risk.

6. Remortgaging Activity Surges in the Second Half of 2026

Millions of borrowers will exit high-rate deals taken during 2023 and 2024.

As rates edge lower and competition intensifies, remortgaging volumes are forecast to surge, prompting:

- Cashback incentives

- Lower product fees

- Competitive retention offers

Borrowers who plan early could significantly reduce monthly repayments.

7. Stress Testing Becomes More Realistic

Mortgage stress testing rules are unlikely to disappear, but lenders are expected to apply them more flexibly.

Affordability checks will increasingly reflect:

- Actual household spending

- Real childcare costs

- Verified discretionary income

This benefits borrowers whose finances do not fit rigid models.

8. Digital Mortgages and AI Underwriting Expand

2026 will see accelerated adoption of digital mortgage journeys.

AI-assisted underwriting, open banking affordability checks, and faster approvals will become standard — especially among challenger lenders and fintech-backed brokers.

This could reduce approval times from weeks to days for straightforward cases.

What Borrowers Should Do Now

Mortgage experts agree on one thing: preparation matters more than prediction.

Borrowers should:

- Review deals at least six months before expiry

- Monitor swap rates and lender announcements

- Speak to a whole-of-market broker

- Stress-test their own budgets conservatively

Stay ahead of rate changes. Follow The World Beast for expert mortgage insights, housing forecasts, and money-saving strategies for 2026.